After your date or record, your liabilities will increase and your retained earnings will decrease. Then after the payment, both your cash account and your liability will be reduced. To demonstrate the journal entries required when a cash dividend is declared and paid, let’s return to the above example. The amount and regularity of cash dividends are two of the factors that affect the market price of a firm’s stock.

10 Dividends

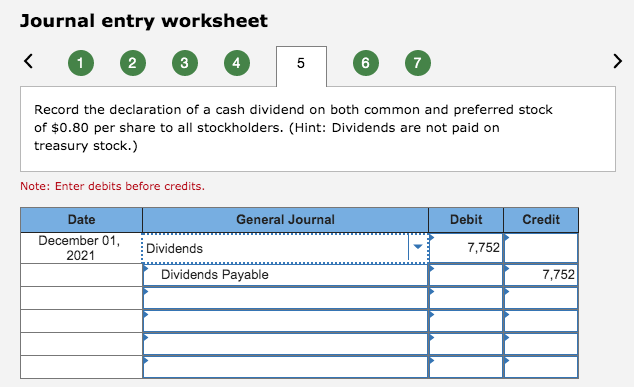

- As soon as the dividend has been declared, the liability needs to be recorded in the books of account as dividends payable.

- The major factor to pay the dividend may be sufficient earnings; however, the company needs cash to pay the dividend.

- As you would expect, dividends shouldn’t impact the operating activities of your company.

- On that date the current liability account Dividends Payable is debited and the asset account Cash is credited.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

A company’s board of directors has the power to formally vote to declare dividends. The date of declaration is the date on which the dividends become a legal liability, the date on which the board of directors votes to distribute the dividends. Cash and property dividends become liabilities on the declaration date because they represent a formal obligation to distribute economic resources (assets) to stockholders. On the other hand, stock dividends distribute additional shares of stock, and because stock is part of equity and not an asset, stock dividends do not become liabilities when declared.

Share This Book

The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. The debit to the dividends account is not an expense, it is not included in the income statement, and does not affect the net income of the business. The balance on the dividends account is transferred to the retained earnings, it is a distribution of retained earnings to the shareholders not an expense. For example, on December 20, 2019, the board of directors of the company ABC declares to pay dividends of $0.50 per share on January 15, 2020, to the shareholders with the record date on December 31, 2019.

What are cash dividends?

However, the principle is the same, you are just able to skip the temporary dividends payable portions of the entry. The end result across both entries will be an overall reduction in retained earnings and cash for the amount of the pay by debit or credit card when you e dividend. The date of record is when the business identifies the shareholders to be paid. Debiting the account will act as a decrease because the money that is being paid out would otherwise have been held as retained earnings.

Cash Dividend

Many corporations, therefore, attempt to establish a quarterly dividend pattern that is maintained or slowly increased over a number of years. In profitable years, the corporation may issue a special year-end dividend in addition to regular dividends. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

In this situation, the date the liability will be recorded in Your Co.’s books is March 1 — the date of the Board’s original declaration. Applying Generally Accepted Accounting Procedures (GAAP), which is required for any public company and a good practice for private companies, means recording the dividend when it is incurred. To be a Dividend Champion, a stock must have paid rising dividends for 25+ consecutive years. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Get instant access to video lessons taught by experienced investment bankers.

This has the effect of reducing retained earnings while increasing common stock and paid-in capital by the same amount. Journalizing the transaction differs, depending on the number of shares the company decides to distribute. To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained earnings and a credit to dividends payable. This entry is made at the time the dividend is declared by the company’s board of directors. The amount credited to the Dividends Payable account represents the company’s obligation to pay the dividend to shareholders. The debit to Retained Earnings represents a reduction in the company’s equity, as the company is distributing a portion of its profits to shareholders.

A small stock dividend is viewed by investors as a distribution of the company’s earnings. Both small and large stock dividends cause an increase in common stock and a decrease to retained earnings. This is a method of capitalizing (increasing stock) a portion of the company’s earnings (retained earnings).

Dividends are typically paid out of a company’s profits, and are therefore considered a way for the company to distribute its profits to shareholders. Dividends are often paid on a regular basis, such as quarterly or annually, but a company may also choose to pay special dividends in addition to its regular dividends. While a few companies may use a temporary account, Dividends Declared, rather than Retained Earnings, most companies debit Retained Earnings directly. When they declare a cash dividend, some companies debit a Dividends account instead of Retained Earnings.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Amy is a Certified Public Accountant (CPA), having worked in the accounting industry for 14 years. She is a seasoned finance executive having held various positions both in public accounting and most recently as the Chief Financial Officer of a large manufacturing company based out of Michigan.