Therefore, relying solely on this ratio to evaluate such companies may not be appropriate. Ultimately, it is up to investors and proprietors to determine the appropriate balance of equity and debt financing based on their risk tolerance and investment goals. It is also known as equity ratio or shareholder equity ratio or net worth ratio. The main purpose of this ratio is to determine the proportion of the total assets of a business that is funded by the proprietors. 2021 u s small business tax checklist is a type of solvency ratio that is useful for determining the amount or contribution of shareholders or proprietors towards the total assets of the business. This calculation can be done easily once you know the total value of equity and the total assets of the company.

What are the types of accounting ratios?

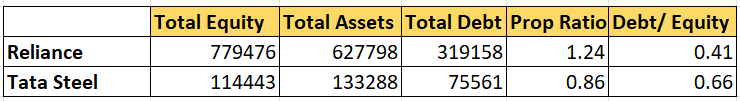

Now, to calculate the proprietary ratio, we’ll need to take the company’s shareholders’ equity and divide it by its total assets. The proprietary ratio shows the contribution of stockholders’ in total capital of the company. A high proprietary ratio, therefore, indicates a strong financial position of the company and greater security for creditors. A low ratio indicates that the company is already heavily depending on debts for its operations. A large portion of debts in the total capital may reduce creditors interest, increase interest expenses and also the risk of bankruptcy.

- However, in the second method, the only thing visible in our financial statements would be the rent.

- The liquidity ratio is used to measure a company’s ability to pay its short-term obligations.

- A high ratio indicates that the company’s capital structure is strengthening, and the business is increasing its shareholders’ capital while decreasing its debt obligations.

- It indicates the proportion of a company’s total assets financed by equity and debt, offering insight into the financial health and stability of a business.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- Out of current assets, inventories and prepaid expenses are not included because these cannot be converted into cash easily.

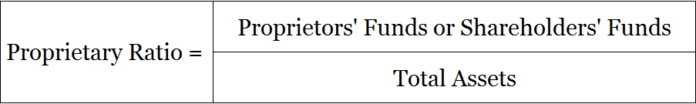

What is the Proprietary Ratio? How to calculate proprietary Ratio?

However, in the second method, the only thing visible in our financial statements would be the rent. If the company’s proprietary ratio is low, investors and company stakeholders should further assess the company’s liquidity to see if the company presents solvency risks. Also, you should consider the company’s cash flow statements to see if there are one-time events or other events that may have impacted the proprietary ratio. When you have a high proprietary ratio, it means that the company is in a good financial position.

How proprietary ratio relates to solvency

It is more valuable when comparing companies within the same sector and finding out a trend of the last few years’ proprietary ratios. Let us understand the calculation of proprietary ratio by using a solved example. It also indicates how much the shareholders will receive in the event of liquidation of the company.

It shows the contribution of owners in the total capital of the business and provides insight into the company’s financial leverage and solvency. Solvency ratios include various metrics such as the proprietary ratio, debt-to-equity ratio, and interest coverage ratio. For example, the debt-to-equity ratio compares the amount of debt a company has to its equity, while the proprietary ratio focuses on how much of the company’s assets are financed by shareholders’ equity. Together, these ratios offer a well-rounded view of a company’s financial standing.

Share This…

A higher ratio better is than the long-term solvency position of the company and also a high ratio is always favourable to the investor. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

A high ratio indicates that the company relies less on debt, leading to a stronger balance sheet and reduced financial risk. It’s particularly useful for comparing companies in the same industry or tracking a company’s financial structure over time. In simple terms, the proprietary ratio is the ratio of shareholders’ equity to the total assets of a company.

The proprietary ratio is a financial ratio that measures the proportion of a company’s total assets that are financed by its shareholders’ equity. Its purpose is to assess the extent to which a company relies on equity financing to support its operations and growth. A company’s capital structure refers to the mix of debt and equity used to finance its operations. The proprietary ratio plays a key role in determining this structure by showing the proportion of assets financed by shareholders versus debt.