The key distinction here is the term “most liquid assets”—these are assets that can be converted into cash quickly (hence the word “quick” in the ratio’s name). Unlike the Current Ratio, which includes inventory in the calculation, the Quick Ratio excludes this less liquid asset. By focusing on more liquid assets, the Quick Ratio emphasizes a company’s ability to pay off its debts quickly, which can be especially critical during economic downturns or unexpected financial hardships. A company can’t exist without cash flow and the ability to pay its bills as they come due. By measuring its quick ratio, a company can better understand what resources it has in the very short term in case it needs to liquidate current assets. The quick ratio communicates how well a company will be able to pay its short-term debts using only the most liquid of assets.

- The acid test of finance shows how well a company can quickly convert its assets into cash in order to pay off its current liabilities.

- It’s advisable to calculate the Quick Ratio regularly, such as quarterly or annually, to monitor changes in liquidity over time.

- It’s a vital tool that helps us understand a company’s short-term liquidity—basically, how well a business can meet its short-term obligations.

Why is it important for a company to have a high quick ratio?

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The calculators provided on this website are for educational purposes only. Users shall be solely responsible when using the information/calculators provided on this website.

Date and Time Calculators

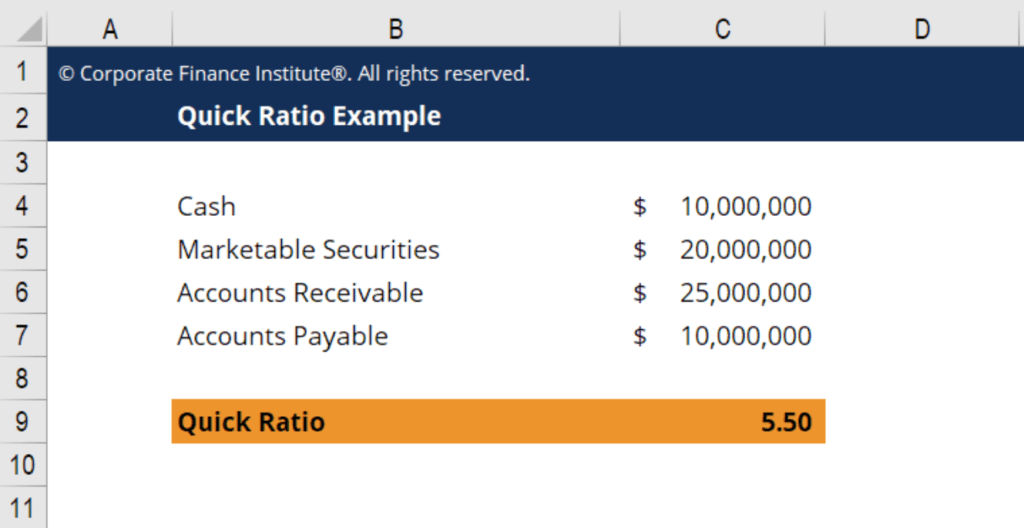

It is calculated by dividing current assets that can be converted into cash in one year, by all current liabilities. Sometimes company financial statements don’t give a breakdown of quick assets on the balance sheet. In this case, you can still calculate the quick ratio even if some of the quick asset totals are unknown. Simply subtract inventory and any current prepaid assets from the current asset total for the numerator.

The Difference Between the Quick Ratio and the Current Ratio

This discrepancy can lead to interesting insights in financial analysis. A company could show a strong current ratio, suggesting sound liquidity. However, a closer examination via the quick ratio could tell a different story, revealing potential weaknesses in liquidity once the less liquid inventory is excluded. Therefore, understanding both ratios and their unique perspectives can provide a more holistic and accurate picture of a company’s short-term financial health. The quick ratio, often referred to as the “acid test ratio,” is a liquidity metric used to gauge a company’s capacity to pay its short-term obligations using its most liquid assets.

Other Liquidity Calculators

For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. A financial professional uber taps wageworks to let commuters pay for uberpool ride will be in touch to help you shortly. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Quick Ratio: Definition, Formula, Uses

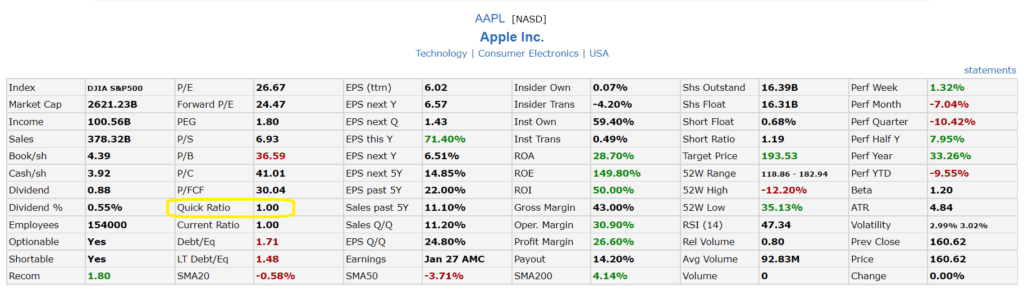

For example, a company may be sitting on a very large cash balance. This capital could be used to generate company growth or invest in new markets. There is often a fine line between balancing short-term cash needs and spending capital for long-term potential. Below is the calculation of the quick ratio based on the figures that appear on the balance sheets of two leading competitors operating in the personal care industrial sector, ABC and XYZ.

Quick assets for this purpose include cash, marketable securities, and good debtors only. In other words, prepaid expenses and inventories are not included in quick assets because there may be doubts about the quick liquidity of inventory. The Quick Ratio is a valuable financial tool for evaluating a company’s liquidity and ability to meet short-term obligations. By calculating the Quick Ratio regularly, you can gain insights into your company’s financial health and make informed decisions to improve its liquidity position. Use our Quick Ratio Calculator to quickly and accurately assess your company’s financial standing and plan for a secure financial future. The Quick Ratio is a measure of liquidity, while working capital represents the difference between current assets and current liabilities.

In terms of accounts receivables, the quick ratio does not take into account the turnover rate or the average collection period. The quick ratio is ideal for short-term creditors who want to know how quickly they will be paid back if the company were to go bankrupt. This means it may suffer from illiquidity which could lead to financial distress or bankruptcy. In addition, considering companies in similar industries and sectors might provide an even clearer picture of the firm’s current liquidity situation.

But the quick ratio may not capture the profitability or efficiency of the company. The quick ratio does not take into account the collectability of accounts receivables. It also ignores other sources of liquidity, such as credit lines. The quick ratio should not be used by companies that have significant amounts of fixed assets, such as real estate or equipment. It also does not provide information regarding the value of its inventory and marketable securities. While the quick ratio is not a perfect indicator of liquidity, it is one tool that analysts use to get a snapshot of how well a company can meet its short-term obligations.